New To Medicare

If you are turning 65, retiring, or have been living on disability for 24 months, we are here to help.

It is important to know that delaying your enrollment in Medicare can result in penalties. You may need to actively enroll, or if you’re receiving Social Security benefits, you might be enrolled automatically. When first enrolling in Medicare, the decisions you make are crucial and can significantly affect your healthcare coverage and costs. It is important that you enroll during a designated period, there are penalties if you miss enrollment deadlines.

Let us help you simplify Medicare. We will explain Medicare in simple terms that you can understand by breaking down the basics. We will answer your questions, and guide and support you throughout your Medicare journey. Contact us today!

What is Medicare?

Original Medicare is a federal health insurance program for those 65 or over, retiring or living on disability (for 24 months), has End-Stage Renal Disease (ESRD), or ALS, also known as Lou Gehrig’s disease.

Medicare is an entitlement program that most U.S. citizens become eligible by contributing through employment and tax payments, usually equivalent to 40 quarters (10 years).

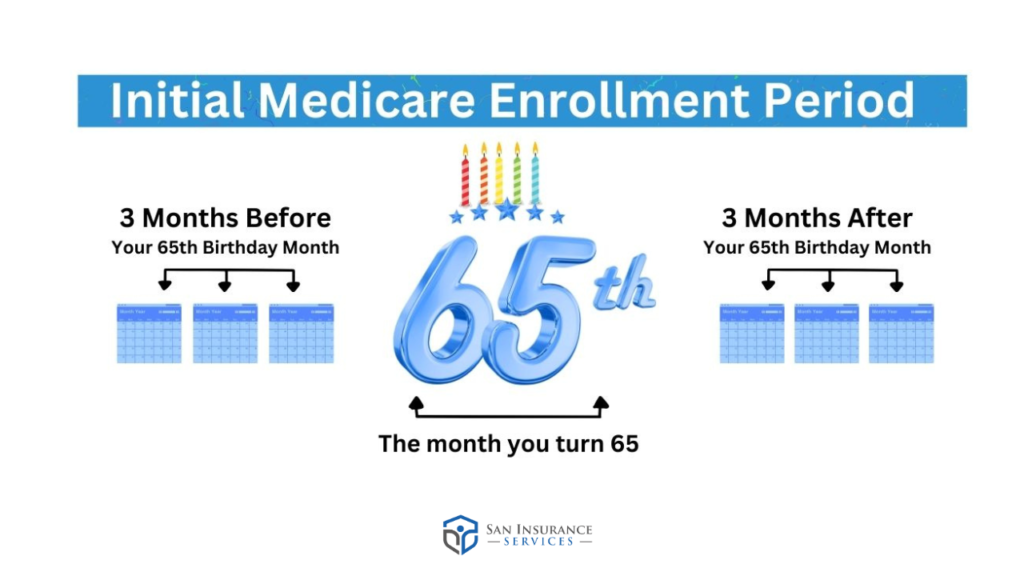

If you miss enrollment deadlines, you could end up with lifetime penalties. As you approach 65, you want to enroll in Medicare during your Initial Enrollment Period (IEP). This seven-month period begin three months before the month you turn 65, includes your birth month, and extends three months after turning 65. If you’re already receiving Social Security or Railroad Retirement Board benefits, you’ll be enrolled automatically in parts A and B on the first day of the month you turn 65.

Medicare Consists of 4 Parts

- Part A is hospital insurance that covers hospital stays (inpatient care), skilled nursing facilities, home health care and hospice care.

- Part B is medical insurance which covers outpatient care such as doctor’s visits, outpatient procedures, x-rays, lab tests, and preventative services; and some medical equipment and supplies. Most people pay a monthly Part B premium. Together, parts A and B are known as Original Medicare or Traditional Medicare.

- Part C known as Medicare Advantage Plans. These plans are offered by private health insurance carriers who have contracts with the government. Medicare Advantage Plans often include hospital and medical insurance coverage (Part A and B), and usually Part D (prescription drug) coverage, and they may offer extra coverage such as vision, hearing, and dental.

- Part D refers to Medicare’s prescription drug insurance, provided by private insurance companies with costs varying based on the covered drugs. Part D plans are available to Medicare beneficiaries, either as standalone prescription drug plans or included within a Medicare Advantage Plan.

Medicare Eligibility

To qualify for Medicare coverage

- Age 65 (or older), a U.S. citizen or a permanent resident, and have resided continuously in the country for 5 years or more

- People who have received Social Security disability for 24 months or longer

- Individuals with end-stage renal disease, which is kidney failure that requires dialysis, or those awaiting kidney transplant

- Have Amyotrophic Lateral Sclerosis (ALS), Also known as Lou Gehrig’s disease

When To Enroll For Medicare

Most individuals typically apply for Part A (hospital) and Part B (medical) when they first become eligible at age 65. Signing up promptly is crucial to avoid any gaps in coverage or late enrollment penalties. However, you may choose to delay enrolling in Part B if you have coverage through your employer’s group health plan.

The initial Enrollment Period (IEP) is a 7-month period, which begins three months before your 65th birthday, the month of your birthday and ends three months after your 65th birthday.

Start To Enroll

Information you need to get started

- Social Security number

- Where you were born (city, state, country)

- Health insurance information

- Start and end dates of your current group health plan

How to Apply for Medicare

- Apply for Medicare is online via the Social Security website. The application process is straightforward and takes about 10 to 15 minutes. Visit the Social Security website and follow the application links.

- Apply by phone, contact Social Security at 1-800-772-1213 and inform the representative that you would like to apply for Medicare. Depending on your specific enrollment situation, they may need to mail you some forms to complete. These forms are relatively simple, but if you have any questions or need assistance, please feel free to give us a call. We assist clients with this process every day and are more than happy to guide you through it.

- To get the application processed quickly, the best option is to apply in person at your local Social Security office. To find the nearest Social Security office, visit the Social Security website. When you are at the office, be sure to ask for a printed confirmation showing you have enrolled in Part A and Part B. This confirmation will allow you to complete your Medicare Supplement and/or Part D applications.

Sign up for part B only

For those 65 and older who already have Medicare Part A and is leaving an employer group plan, you only need to apply for Part B. You will need to complete CMS-L565 (employer verification form) and CMS 40-B (application to enroll in Medicare Part B). Complete these two forms and return to your local Social Security office.

Sign up for Part B online: https://www.ssa.gov/medicare/sign-up/part-b-only

Information you need to apply for Part B

- Valid email address

- Your existing Medicare number

- Completed CMS-L565 (employer verification form)

Enrollment Periods

Initial Enrollment Period (7 months period)

The Initial Enrollment Period (IEP) is 7 months when Medicare eligible first can sign up for Medicare.

7 months surrounding your Medicare eligibility date:

- 3 months before your Medicare eligibility or 65th birthday

- The month of your Medicare eligibility or 65th birthday

- 3 months after your Medicare eligibility or 65th birthday

Special Recognition to our Veterans. THANK YOU FOR YOUR SERVICE! If you are eligible for TRICARE For Life (TFL), you must enroll in Medicare Part B during this time.

Annual Enrollment Period (October 15 to December 7)

The Annual Enrollment Period (AEP) occurs between October 15 to December 7 each year. During this time, Medicare beneficiaries can switch from Original Medicare to a Medicare Advantage plan or vice versa, change from one Medicare Advantage plan to another, or switch between Medicare Advantage plans with or without drug coverage.

Additionally, you can enroll in a Medicare Part D prescription drug plan or switch to a different plan if you are already enrolled. You can also drop your Part D coverage entirely without penalty if you have obtained creditable coverage through an employer or another source.

Plan changes made during AEP take effect on January 1st of the following year.

Medicare Advantage Open Enrollment Period (January 1 to March 31)

The Medicare program offers you a chance to reconsider your decision regarding a Medicare Advantage plan. If you enroll in one and find it unsuitable for any reason, you can disenroll during the Medicare Open Enrollment Period, which takes place from January 1st to March 31st.

- You can make a one-time change Medicare Advantage plan

- Return to Original Medicare and elect a Part D drug plan to accompany it

Note: It’s important to note that if you decide to return to Original Medicare and intend to enroll in a Medigap plan, approval is not guaranteed. In numerous cases, you may be required to respond to health-related inquiries for the Medigap plan, and the provider isn’t obligated to accept your application.

Special Enrollment Period

A Special Election Period (SEP) allows beneficiaries to switch to a new Medicare Advantage or Part D prescription drug plan following a qualifying life event. Additionally, beneficiaries can return to Original Medicare without penalty and may be able to enroll in Medigap under guaranteed issue rights without medical underwriting, depending on state rules. You have a two-month window to enroll in either a Medicare Advantage or Part D plan during this period.

Here are several qualifying life events that allow an individual for a Special Enrollment Period:

- Move to a new address that isn’t in your current service area

- Lose current health coverage, such as employer group insurance

- Become eligible for Medicaid

- Qualify for Extra Help to pay for Medicare prescription drug coverage or losing eligibility for Extra Help

- Losing coverage through a Medicare Advantage plan because the plan is no longer offered, or the plan leaves the Medicare program

- And other special situations:

- Federal Disaster or Other Emergency (FEMA-declared emergency)

- Trial Rights for Medicare Advantage – Try Medicare Advantage for the first time, or leave a Medicare Advantage plan within the first 12 months of joining and return to Original Medicare

- Medigap Enrollment – When you have a guaranteed issue right for Medigap, usually due to specific situations like leaving a Medicare Advantage plan or moving out of the plan’s service area.

These Special Enrollment Periods allow beneficiaries to make changes to their Medicare coverage outside of the standard enrollment periods, based on specific qualifying events.

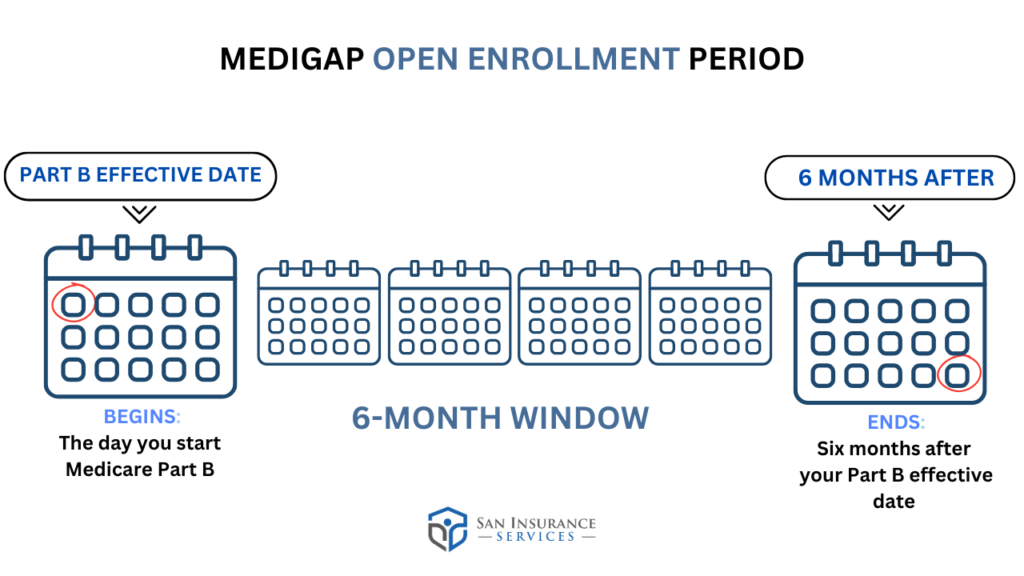

Medicare Supplement Enrollment Period (6 months period)

The Medicare Supplement Open Enrollment Period is a six-month period that begins on the first day of the month in which you are both 65 or older and enrolled in Medicare Part B. During this time, you have a guaranteed right to buy any Medicare Supplement (Medigap) policy sold in your state, regardless of any pre-existing health conditions. Insurers cannot deny you coverage or charge you more due to health issues during this period.

We're Always Here For You.

By submitting your information, you agree that an authorized representative or licensed insurance agent may contact you by phone or email to answer your questions or provide additional information about Medicare Advantage plans, Prescription Drug Plans or Medicare Supplement Insurance plans. This is an advertisement for insurance.